The common rule of thumb is to put 20% of yearly income into savings.

So, how much is 20%?

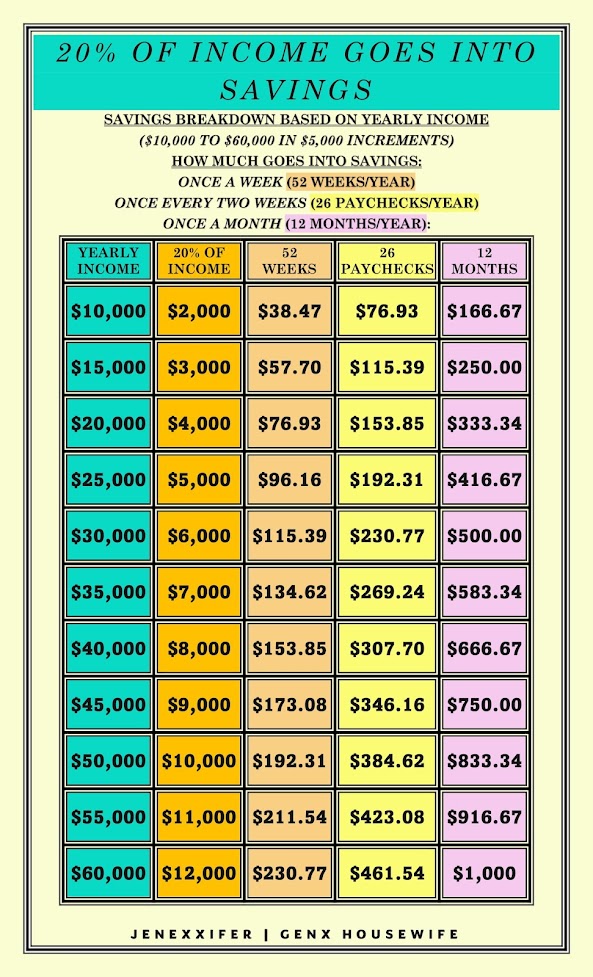

I created the chart above as a reference guide to show exactly how much 20% is for yearly incomes ranging from $10,000 to $60,000, in increments of $5,000.

I also included three columns that show how much money should go into savings every week, every two weeks, or every month, depending on how often a person gets paid.

The income examples above represent a range, but I know that most yearly incomes aren’t even numbers in increments of $5,000.

So, I also made a spreadsheet in Google Docs entitled 20% Yearly Income Savings Goals that anyone can access to figure out 20% of their exact yearly income, including how much to deposit into savings every week, two weeks, or month.

👉 Click here to go to the spreadsheet!

Below is a short desktop video (no audio) that shows how the spreadsheet works, and there are also instructions included on the spreadsheet:

1. Type amount of yearly income in cell A2 and press enter (this is the only cell that can be edited by anyone with the link; all other cells are tamper-proof).

2. Click ‘okay’ when the editing warning box appears.

3. All other cell values will automatically change based on the yearly income.

4. Use the information to save 20% of income each year with weekly, two-week, or monthly savings deposits!

👉 Watch the video and then click here to go to the spreadsheet!

I know that people make more than $60,000 a year, but here is a fact to consider:

According to the U.S. Census Bureau publication ‘Income and Poverty in the United States: 2020’ the median household income in 2020 was $67,521, and it actually decreased 2.9% from 2019 when the median household income was $69,560.

That means that half of the U.S. households in 2020 had incomes more than $67,521, and half of the households had incomes less than $67,521.

I believe it is the people who have incomes under the median amount that need the most help when it comes to improving their financial situations -- and that is half the households in the U.S.!

I have no doubt people who make high five figures or six figures a year have financial struggles too, but they also have higher incomes and that puts them in a different category than someone making less.

Households with an income under $60,000 are closer to poverty; and even if they have a good buffer, they are still numerically closer to poverty than households with higher incomes.

I have lived through the struggle of a yearly income of $30,000 for two adults in a rural area where business growth is almost at a standstill, and where working for a million-dollar homebuilder meant we qualified for a Habitat for Humanity home based on our income.

We also came close to meeting the criteria to qualify for food stamps, and that was where I drew the line because that was never a goal of mine.

We worked our way up from $30,000 a year by learning to live within our means, putting money into savings, and then increasing our means; my husband had his Veteran’s benefits reevaluated and his monthly benefits increased, he soon found better paying work, and then he started his own business which we own together.

We are still not at the median household income from 2020, but we are closer to it now than a few years ago – and that’s an improvement that happened from knowing our income and tracking our spending, changing our spending habits, paying off debt, putting money into savings, and making our financial wellbeing a top priority.

Now we are better off financially with no more credit debt, no more living paycheck to paycheck, no more living on credit, and we have money in savings that grows with every paycheck.

My hope is that the information in the reference guide and the spreadsheet are tools that can help others get a handle on their finances so they can get out of debt, get away from poverty, and get their finances moving in a better direction.

It takes work, but it also takes knowledge, because knowing is half the battle; when a person knows what they need to do, it's easier to do it -- knowing how much to save each year and put into savings every week, two weeks, or month, makes it easier to do than not knowing!

Happy saving!

PS - I know there are people who struggle with less than $30,000 a year, and I know there are people who struggle with more than $30,000 a year and still think they have a low income even if it's never been as low as what I've lived with; so, I know there are people with worse experiences than mine and I know my experiences aren't the worst, and I also know that my experiences are not what others have experienced and most likely wouldn't want to experience. I'm not comparing my experiences, just sharing what I've been through because it's my journey.

👉 Click here to go to the 20% Yearly Income Savings Goals spreadsheet!

👉 What does saving money feel better than? Find out here!

👉 Learn How to Save Money When You Don't Have Money; based off my own experiences that I hope can help others avoid the mistakes I made!

👉 Then read my post There's No Fun During a No-Spend Challenge when it's time to get serious about not spending money to get out of debt!

.jpg)

Very cool. Thanks for sharing.

ReplyDeleteThank you!

DeleteAbsolutely love this! I am definitely going to implement your concept going forward.

ReplyDeleteThank you! I'm glad it helps and good luck with your goals!

Delete