If you have found this page, you are most likely where I once was -- wondering how to save money when you don't have money.

Here are some things I learned about saving money when my husband and I didn't have money and went through some challenging financial times.

I hope this information helps others; please leave questions in the comments or send them through the contact form in the sidebar.

First of all, money can't be saved if there is no money to save:

Living paycheck to paycheck, and living in a debt hole, guarantees there is no money for savings.

The solution is to find out where the money is going.

👇👇👇

How to find out where the money is going:

What has to happen before saving money is tracking money with bookkeeping, and not just looking at a bank statement or an app that shows single transactions.

Bookkeeping, to me, is about adding up the numbers to get an accurate view of where the money goes, rather than looking at single transactions of $30 here and $40 there.

Seeing the total amount of money spent is what created a change in our spending habits; when I got a gut-wrenching knot in my stomach from seeing how much we spent on eating out while being in debt and living on a credit card, that was what I needed to change my ways.

When I started keeping the books by adding up all the receipts from our spending, along with our essential household bills for utilities and rent, that's when I started seeing where the money was going, and from there we were able to change our spending habits and redirect where we wanted the money to go: paying off credit debt and growing our savings.

👇👇👇

How to start bookkeeping in 4 steps:

Step 1. Gather all the receipts spent on non-essentials for the week or the month, especially dining out, and add up the receipts to see the total amount spent. (Non-essentials include, but aren't limited to: entertainment, gambling, dining out, drinking, shopping, pampering. If it's not essential at the most basic level of living such as heat/electricity, nutrition, shelter, work transportation, it's non-essential.)

This can be done with paper, pencil, and a calculator (journal style); or make an Excel spreadsheet or use another form of software; what's most important is being familiar with the tools.

It helps to know if the expenses are paid with debit, cash, or credit; expenses paid with debit will be on a bank statement, whereas expenses paid with cash won't be traced except for a receipt, and credit expenses will be on the credit statement (credit expenses are likely to come with interest if the balance isn't paid off monthly, so paying attention to credit expenses helps to understand that more money is being spent on those items than with debit or cash).

|

| Bookkeeping example using Excel spreadsheet and sum function (non-essentials) |

If receipts aren't being saved, then that is a sign to start saving receipts, especially when purchases are made with cash. Otherwise, use a bank/credit statement to refer to the amounts, and use those amounts to create a tally of expenses for a week or a month.

Receipt tip: Make a physical in-box just like in an office where inbound papers go and keep receipts stored for the week; once a week add those receipts to the tally in the bookkeeping journal or software. Staying current with bookkeeping once a week is easier than doing weeks or months of catch-up.

Step 2. Gather all receipts spent on essentials for the week or the month and add up the receipts to see the total amount spent. (Essentials include, but are not limited to: rent/mortgage, utilities, insurances, nutrition, work transportation, outstanding debts.)

If there are no receipts, refer to a bank/credit statement that shows the amounts, and use those amounts to create a tally of expenses.

|

| Bookkeeping example using Excel spreadsheet and sum function (essentials) |

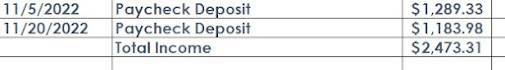

Step 3. Gather all paycheck stubs or refer to bank statement that shows deposits for the month; add those amounts up to find out monthly income.

Monthly income may be different from month to month, especially for hourly earners versus salary earners.

|

| Bookkeeping example using Excel spreadsheet and sum function (income) |

Step 4. Add all non-essential and essential expenses together to see how much in total is spent in the month and compare it to the income.

| |

|

If more is spent than comes in, that creates a negative amount which is a deficit, and that means spending on non-essentials needs to stop and spending on essentials may need to be adjusted to stop overspending.

Credit card spending also needs to stop because that isn't even money -- it's debt that comes with an interest charge, and the more credit is relied on the more the debt hole grows.

The goal is to have a surplus at the end of each month, which means there is money left over and less money is spent than comes in.

👇👇👇

How bookkeeping leads to getting out of debt, saving money, and making a budget:

If the amount spent on non-essentials for a week or a month is enough money to put towards bills to pay down debt, catch up on rent/mortgage, or to get out of collections for utilities, then that's a sign to stop spending money on non-essentials -- and it takes bookkeeping to figure it out.

Once money is no longer spent on non-essentials, all that money can go towards essential bills, debts, and savings; and that's where a budget comes in, after bookkeeping.

It's bookkeeping that shows where money is going, and that has to happen before a budget can be made. The theory may be that 30% of income goes to a home, but if bookkeeping shows that 40% is actually going towards a home, that can throw off a theoretical budget if the actual amounts aren't known.

Without bookkeeping, a budget can't exist; knowing where the money goes happens before deciding where the money goes.

👇👇👇

How to change spending habits:

Example: if $50 is spent every Friday on dining out, then in four weeks that is $200.

The question to ask is this: Can that $200 make a difference for the better if spent on essential household bills, to keep the lights and heat on, to pay down debt, to grow savings?

If the answer is yes and $200 can make a difference if it wasn't spent on dining out, then the solution is to stop spending $50 every Friday on dining out; take that same $50 and apply it towards essential bills or debt for the month.

Stop dining out on Fridays to save $50 every week until all bills are caught up and debts are paid off; then, when that has happened, that $50 can be put towards savings.

If there are multiple expenditures throughout the week that are non-essential (drinking, gambling, shopping, pampering), do the same thing; apply that money to essential household bills and debts; once the bills are covered and debts are paid off, that money can go into savings.

If saving money needs to happen sooner than later, then put $40 of the $50 dining out money towards bills and put the other $10 into savings; start with $10, don't touch it, and continue to add to savings with each paycheck.

Example: if $500 is owed on a credit card, and $200 can be applied towards it each month by not dining out on Fridays, then it would only take 3 months to pay off the balance.

Once the balance of $500 is paid off, then the $200 saved each month can then be applied to other outstanding debts or put into savings; this is known as the snowball method.

Some debts may take longer to pay off than three months, but that is no reason not to start the process; time is going to pass no matter what and the question to ask is: where do you want to be a year from now -- with debts paid off, or in the process of paying them off; or still stuck living paycheck to paycheck, and not knowing where the money goes each month?

Keep in mind, these changes aren't forever; these changes are necessary to improve the situation, and once the situation is improved wiser choices will be made when it comes to spending money.

When debts are paid off and bills are caught up, a celebration is a reasonable goal; however, after all the hard work and learning from experience the challenge of getting out of a debt hole, it might not be so tempting to spend money on frivolities if they create more problems.

👇👇👇

What if changing spending habits isn't enough:

This is also why bookkeeping is important; not only does it bring to light where the money is going, but it shows if more money is needed.

While cutting spending is the first step, the next step may be to increase income.

But before income can be increased, spending must be under control, because it won't ever matter how much comes in if it is never known how much is going out and where it is going.

👇👇👇

How long does it take to change spending habits:

Instilling new habits can take anywhere from 18 days to more than 200 days. (Source link)

If changing spending habits is still hard after two weeks, it should be, and it could still be hard even after six or eight weeks.

Changing spending habits can also be hard if friends/family aren't supportive; if they aren't supportive, they aren't needed; just like giving up smoking or drinking, if spending is a bad habit that is shared with others than those relationships may fall by the wayside in order to improve a financial situation.

What helped me was to look at my deficits and feel that knot in my stomach; the only way that knot went away was to stop spending what we didn't have and to make do with what we did have. It didn't happen overnight, but with time our habits got better, and we are now better than we ever thought we could be -- and we still have more room to improve!

If we could do it, others can do it, and thousands of people do it all the time every day -- it's just a matter of taking action and starting!

👇👇👇

Take Action Summary:

Remember: Bookkeeping comes before saving money when you don't have money.

Start with bookkeeping to know where the money goes each month and how much is coming in; gather receipts and bank statements to start the bookkeeping process now if you have never done it.

Add up all the money that is spent (credit, debit, cash) and all the income for the month; if more goes out than comes in, there will be a deficit (negative debt hole) and that has to stop.

Assess where the money goes (non-essentials vs. essentials) and figure out changes to make in spending habits to cover essentials, debts, and savings.

Prepare for a no-spend challenge and read my post: There's No Fun During a No-Spend Challenge

Find out how much to save with my 20% Yearly Income Savings Goals Reference Guide

Don't get discouraged; the process can be slow, uncomfortable, and confusing; search for free resources online, ask questions, but don't give up; financial wellness is worth it.

🌸🌸🌸

I know how awful it feels to struggle with finances, and I don't wish that on anyone.

The road to our financial wellness started with bookkeeping, and I encourage others to start there if they don't know where to start when it comes to saving money when you don't have money.

I hope this information helps and please feel free to leave questions/comments below, or use the contact form in the sidebar.

Disclaimer: I am not a trained bookkeeper or licensed in any way beyond being a wife; I am trained in record keeping and I know from experience the importance of getting out of a financial debt hole to avoid poverty, depression, and misery.

.jpg)

Good tips and an excellent write up.

ReplyDeleteThank you!

Delete